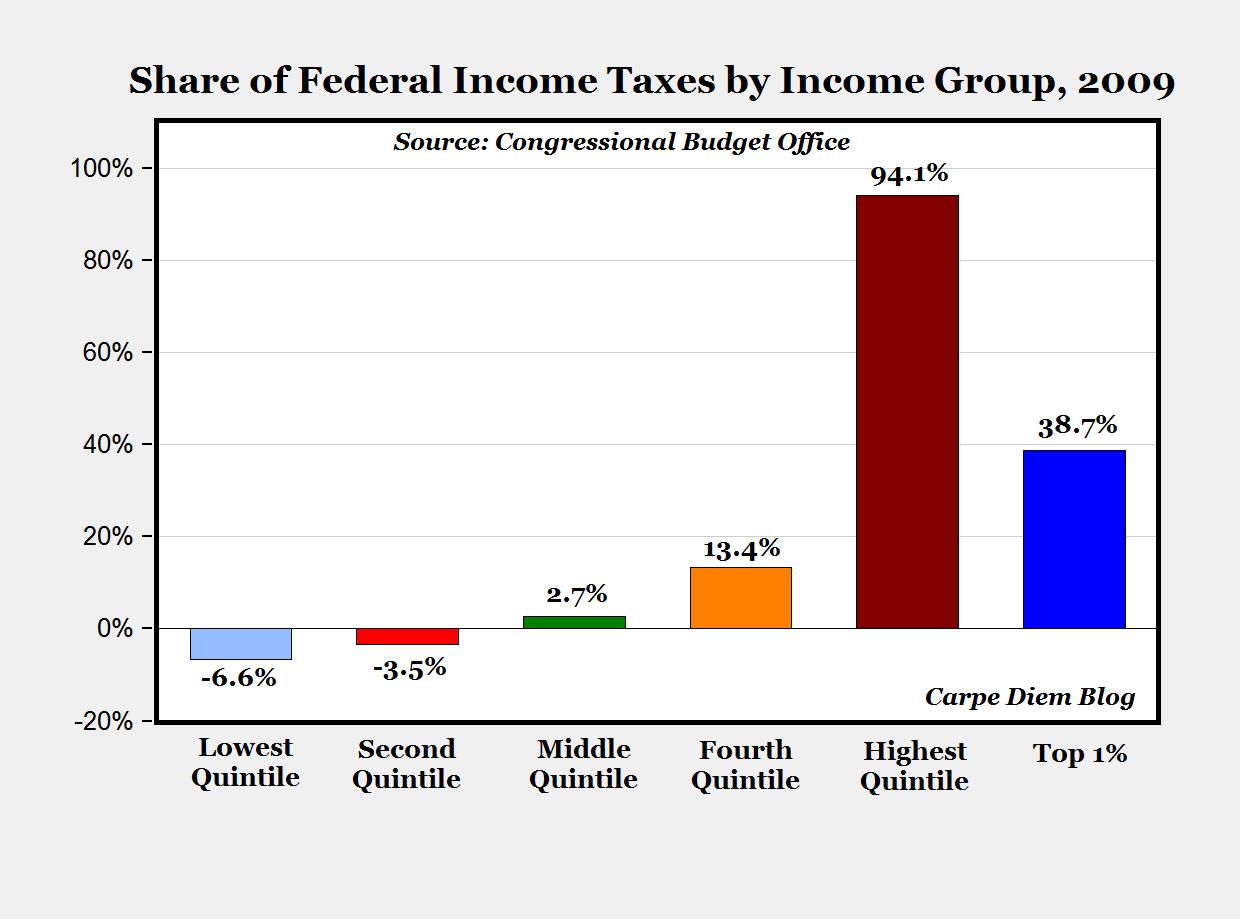

I agree that for all except the top 1%, we are saying the same thing. I even agree that we have a problem when people collect money from a tax instead of paying any in (the lowest 40%). I can understand (not agree with but understand) if they paid 0. But there are several tax credits (child and earned income to name two) that have turned our tax system into a wealth redistribution system, and that is simply wrong. It corrupts anyone's faith and understanding of taxes.Paladin wrote: ↑Wed Jun 16, 2021 7:23 amI think we are largely saying the same thing... with the exception of the wealthiest. When George Soros paid ZERO tax (that is ZERO POINT ZERO ZERO) for 3 years.... he was not representative of the 5th quintile (my group) which is paying an exorbitant share of taxes.

The hidden object of the "progressive" personal income tax is to serve as an obstacle for the 5th quintile from becoming as wealthy as the 0.001%. It's much harder to save when your earnings from labor are heavily taxed (Currently 37%... at one time the top rate was 94%)

I am not sure I agree with your last statement. For one thing, when the top 1% of the income earners pay 38.7% of the taxes collected in the country I cannot say they are paying next to nothing. And I am not sure the goal of the tax system is to stop anyone from moving up in income at any level, though I will stipulate that it does have a tendency towards that effect. This has led to the common belief that there are times where a small pay raise actually increases your taxes enough to reduce your take-home income by moving you to a higher tax bracket. I know it does not really do that because of the way the taxes are calculated, but it is a common belief.

But everything we have both said is why I strongly support a flat tax rate. If you have income, and I don't care what the source is as a general rule, you pay X percent in income tax. I love the idea of making it a straight 10% and then saying the government has to live on whatever income that generates, but I am not sure that is really feasible. I have suggested taking the federal budget and subtracting any income from other sources (other taxes, customs duties, etc.) and dividing the remainder by the average per capita income in the US. The resulting percentage is the flat rate tax level. And it can never be raised higher than the first year we do this.

So we both agree, I think, that our income tax system needs to be fixed. We may not agree on the exact fixes, but we agree it needs fixing.